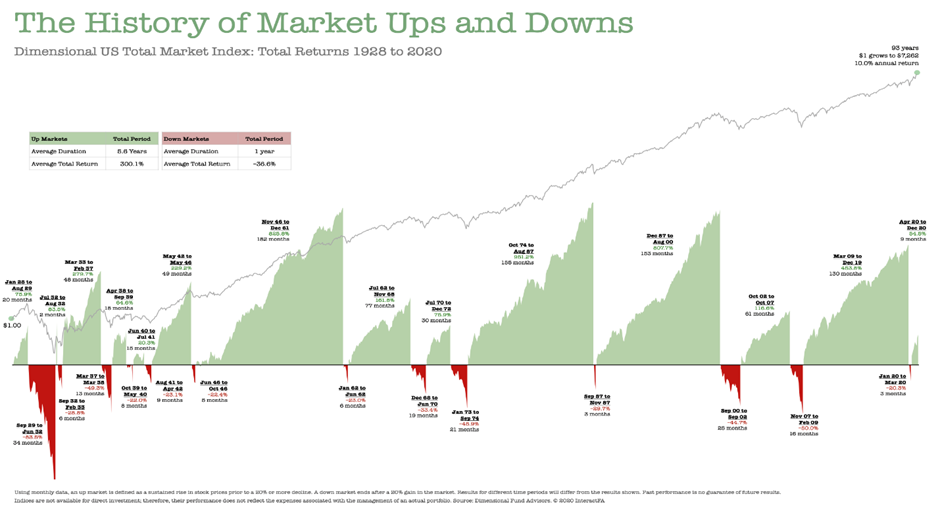

Events causing market volatility is unavoidable. It is part of normal and healthy market behavior. Just like seasons, markets move through stages of growth, slowing down and speeding up. The markets are driven by Fear and Greed.

Diversification is a core technique for reducing risk. Holding a variety of investments can help lower the emotional impact of panic or fear if one of those investments gets into trouble.

Market swings can be troubling when it comes to your money. Instead of being worried, the best course of action is to be prepared. The good news is that there are strategies for dealing with market ups and downs. Strategies you can follow to ensure you haven’t taken on too much risk, and that help you focus on what matters when your news feed is filled with scary messages about struggling markets. Learned more about your risk tolerance, and discovered the importance of having a plan when dealing with market volatility.

Ask about:

Low volatility funds, low volatility funds tend to underperform the market on the way up and outperform it on the way down.

Dividend-paying stocks funds, that mainly invest in companies that pay dividends). Dividend-paying companies are typically well established and financially healthy, which can be a sign of strength and stability.

Income-focused balanced funds, these funds diversify among two or more asset classes to give you a steady stream of income and long-term growth, with lower risk and volatility. They typically invest in bonds (lower-risk, fixed-income securities) and companies that pay dividends.

Managed solutions funds, managed solutions are portfolios that are built using a diversified mix of underlying funds, each of which are professionally managed.

While dramatic moves in the market can make you question your investment plan, it’s important to remember not to panic. When the market does drop, the historical facts show that eventually it always comes back even stronger.

Deb Deering